Understanding the importance of HR compliance in AI-driven environments

Why HR compliance matters in the age of artificial intelligence

As artificial intelligence becomes more integrated into human resources, the importance of compliance grows. Companies must navigate a complex landscape of laws and regulations that govern employment, pay transparency, employee classification, and data privacy. These requirements are not just about avoiding penalties—they help ensure fair treatment for employees and build trust in HR practices.

AI-driven tools can streamline hiring, payroll, and training, but they also introduce new compliance challenges. For example, automated decision-making in recruitment or pay can unintentionally violate local laws or federal state regulations if not carefully monitored. A robust compliance checklist is essential to help ensure your company’s policies and procedures align with legal requirements at every level—federal, state, and local.

- Employment laws and regulations are constantly evolving, especially as AI changes the way work is managed.

- Employee data privacy and security must be protected, with clear policies for handling sensitive information.

- Payroll tax, social security, and workers compensation rules require accurate employee classification and reporting.

- Open enrollment, pay, and benefits administration must comply with both state and federal requirements.

Staying compliant is not a one-time task. It requires ongoing training for HR teams, regular review of company policies, and collaboration with legal counsel to address new risks. As AI continues to shape HR practices, organizations need to update their compliance checklist every year to reflect changes in laws regulations and technology. For a deeper look at how AI is transforming HR compliance, explore this in-depth analysis of modern practices.

Key regulations impacting AI in human resources

Major Legal Requirements for AI in HR

As artificial intelligence becomes more embedded in human resources, companies must navigate a growing landscape of laws and regulations. These requirements are designed to protect employees, ensure fair practices, and help organizations avoid costly legal pitfalls. A robust compliance checklist is essential for HR teams to keep up with evolving federal, state, and local laws.

- Employee Classification: AI tools used in hiring and workforce management must align with legal definitions of employee status. Misclassification can lead to penalties related to payroll tax, social security, and workers compensation.

- Pay Transparency and Fair Pay: Many states now require companies to disclose pay ranges in job postings and ensure pay equity across roles. AI-driven compensation analysis must comply with these pay transparency laws and support fair employment practices.

- Data Privacy and Security: HR systems powered by AI handle sensitive employee data. Compliance with privacy laws such as the General Data Protection Regulation (GDPR) and state-specific requirements is critical. This includes policies for data storage, access, and employee consent.

- Anti-Discrimination Regulations: AI in hiring and promotion must be regularly audited to ensure compliance with anti-discrimination laws. This helps prevent bias and supports fair treatment for all employees.

- Open Enrollment and Benefits: Automated benefits administration must meet federal and state requirements for open enrollment periods, employee notifications, and accurate payroll deductions.

Building a Comprehensive Compliance Checklist

To help ensure compliance, HR leaders should develop a checklist that covers:

- Review of company policies and procedures for alignment with current laws and regulations

- Verification of employee classification and payroll practices

- Regular updates to reflect changes in state local and federal requirements

- Ongoing training for HR teams on legal updates and best practices

- Consultation with legal counsel to address complex compliance issues

Staying informed about new laws regulations is crucial as AI continues to transform HR. For a deeper look at how AI is changing HR reporting and compliance, check out this resource on how AI is changing HR reporting for the better.

Data privacy and security considerations for HR AI systems

Protecting Sensitive Employee Data in AI Systems

As artificial intelligence becomes more integrated into human resources, protecting employee data is a top priority. HR teams must ensure compliance with federal, state, and local laws and regulations regarding data privacy and security. This means understanding the requirements set by frameworks like GDPR, CCPA, and other relevant data protection laws, especially when handling sensitive information such as payroll, social security numbers, and employee classification details.

AI-driven HR systems often process large volumes of personal data, including pay, employment history, and even open enrollment choices. To help ensure data privacy, companies should develop clear policies and procedures for data collection, storage, and access. Regularly updating your compliance checklist is essential to reflect changes in laws and best practices. Legal counsel can provide guidance on how to align your company policies with evolving regulations.

- Limit access to sensitive data to only those employees who need it for their work

- Implement robust encryption and authentication measures

- Train HR staff on data privacy requirements and secure handling of information

- Conduct regular audits to identify and address potential vulnerabilities

It’s also important to consider the implications of AI on payroll tax, tax withholding, and workers compensation data. AI can streamline these processes, but only if the systems are designed to comply with all relevant laws and regulations. For a deeper look at how AI can help navigate payroll complexities while maintaining compliance, check out this guide to payroll compliance in AI-powered HR environments.

By embedding data privacy and security into your HR compliance checklist, you help ensure that your company meets legal requirements and builds trust with employees. This proactive approach supports fair and transparent practices in hiring, training, and ongoing employment management.

Mitigating bias and ensuring fairness in AI-driven HR decisions

Addressing Bias and Promoting Equitable AI Outcomes

AI-driven HR systems can streamline hiring, payroll, and employee management, but they also introduce new compliance risks. One of the most pressing concerns is the potential for bias in automated decision-making. Laws and regulations at the federal, state, and local levels increasingly require companies to ensure fairness in employment practices, especially when using artificial intelligence. To help ensure compliance and fairness, companies should integrate the following practices into their compliance checklist:- Audit AI algorithms regularly to identify and mitigate any patterns of discrimination in hiring, pay, or employee classification. This is not just a best practice—it is a requirement under many state and federal laws.

- Document policies and procedures for how AI systems are used in employment decisions. Clear documentation helps demonstrate compliance with legal requirements and supports transparency for employees.

- Review data sources used by AI tools to ensure they do not reinforce historical biases. This includes checking for balanced representation across gender, ethnicity, and other protected characteristics.

- Establish a process for employee feedback on AI-driven decisions. Employees should have a way to challenge or appeal outcomes they believe are unfair, supporting both legal compliance and company values.

- Engage legal counsel to review AI-related policies and practices. Laws and regulations around pay transparency, employee classification, and hiring are evolving rapidly, so expert guidance is essential.

Training and upskilling HR teams for AI compliance

Building AI literacy and compliance awareness in HR teams

As artificial intelligence becomes more integrated into human resources, it is essential for HR professionals to understand not only how these systems work, but also the legal and ethical requirements that come with them. Training and upskilling are now critical elements of any compliance checklist, helping ensure that employees are equipped to manage new risks and responsibilities.

- Understanding laws and regulations: HR teams must stay updated on federal, state, and local laws that impact AI-driven hiring, pay transparency, employee classification, and data privacy. Regular training sessions can help ensure compliance with evolving requirements.

- Company policies and procedures: Employees should be familiar with company policies that address the use of AI in employment practices, payroll, and open enrollment. Training should cover how these policies align with legal standards and best practices.

- Ethical use of AI: Training should emphasize the importance of mitigating bias and ensuring fairness in AI-driven decisions. This includes understanding how algorithms can impact hiring, pay, and employee classification, and how to identify potential risks.

- Data privacy and security: HR professionals need to know how to handle sensitive employee information in compliance with laws regulations such as GDPR or state-specific data privacy acts. This includes training on secure data handling, payroll tax, tax withholding, and social security information.

- Regular updates and continuous learning: The AI landscape and legal environment are constantly changing. Companies should schedule annual or bi-annual training to keep HR teams informed about new compliance requirements, workers compensation rules, and updates to employment laws.

Practical steps for effective upskilling

To help ensure your HR team is prepared, consider these practical steps:

- Develop a structured training program that covers both technical and legal aspects of AI in HR.

- Include real-world scenarios and case studies to illustrate compliance challenges and solutions.

- Encourage collaboration with legal counsel to interpret complex regulations and adapt company policies accordingly.

- Maintain a clear documentation process for all training activities to demonstrate compliance during audits.

By investing in ongoing training and upskilling, companies can better navigate the complexities of AI in human resources, reduce compliance risks, and foster a culture of responsible innovation in the workplace.

Regular auditing and updating your HR compliance checklist

Keeping Your Checklist Current: A Practical Approach

Staying compliant in the AI era means more than just creating a checklist once and forgetting about it. With laws, regulations, and best practices evolving rapidly, especially around artificial intelligence, your company’s HR compliance checklist must be a living document. Here’s how to keep your compliance efforts effective and up-to-date:- Schedule Regular Reviews: Set a recurring time each year—ideally quarterly or biannually—to review your compliance checklist. This helps ensure your policies and procedures reflect the latest federal, state, and local laws, including updates on pay transparency, employee classification, and payroll tax requirements.

- Monitor Legal Changes: Assign responsibility to a dedicated HR team member or legal counsel to track changes in employment laws and regulations. This includes monitoring updates on social security, workers compensation, tax withholding, and open enrollment rules that may impact your company’s practices.

- Audit AI Systems: Regularly audit your AI-driven HR tools for compliance with data privacy and security requirements. Ensure that employee data is handled according to company policies and legal standards. This also helps mitigate risks related to bias and fairness in hiring and payroll decisions.

- Document and Communicate Updates: When you update your checklist, clearly document the changes and communicate them to all relevant employees. Training sessions or briefings can help ensure everyone understands new requirements and practices.

- Engage Stakeholders: Involve key stakeholders from HR, IT, and legal teams when updating your checklist. Their input helps ensure compliance from multiple perspectives and supports a culture of accountability.

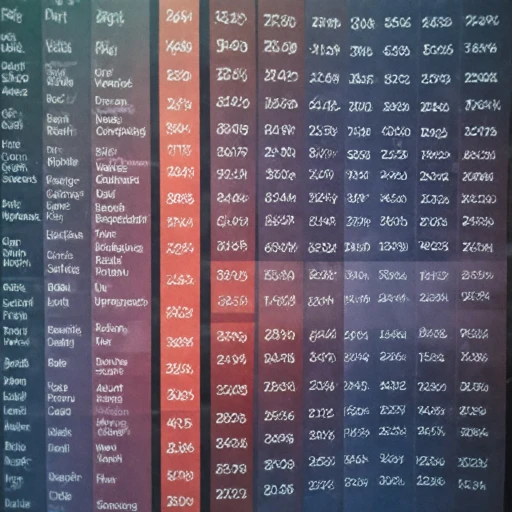

| Compliance Area | Review Frequency | Responsible Party |

|---|---|---|

| Federal, State & Local Laws | Quarterly | Legal Counsel / HR |

| AI System Audits | Biannually | HR / IT |

| Employee Training | Annually or as needed | HR / Training Team |

| Payroll & Tax Withholding | Quarterly | Payroll / Finance |